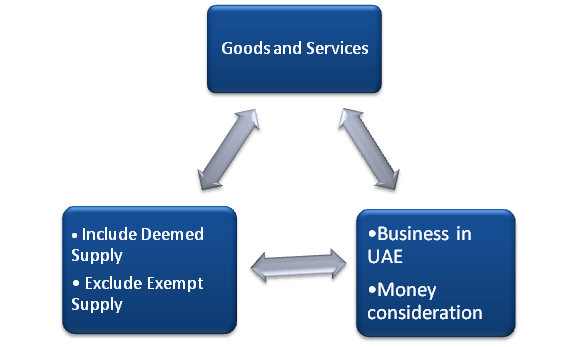

Schedule 1 - GST || Deemed Supply || Supply Under GST || CA IPCC/Inter/Final || Simple and Short - YouTube

Contract involves Services, as well as Supply/Deemed Supply of Goods, can only Classify under head 'Works Contract Services': CESTAT

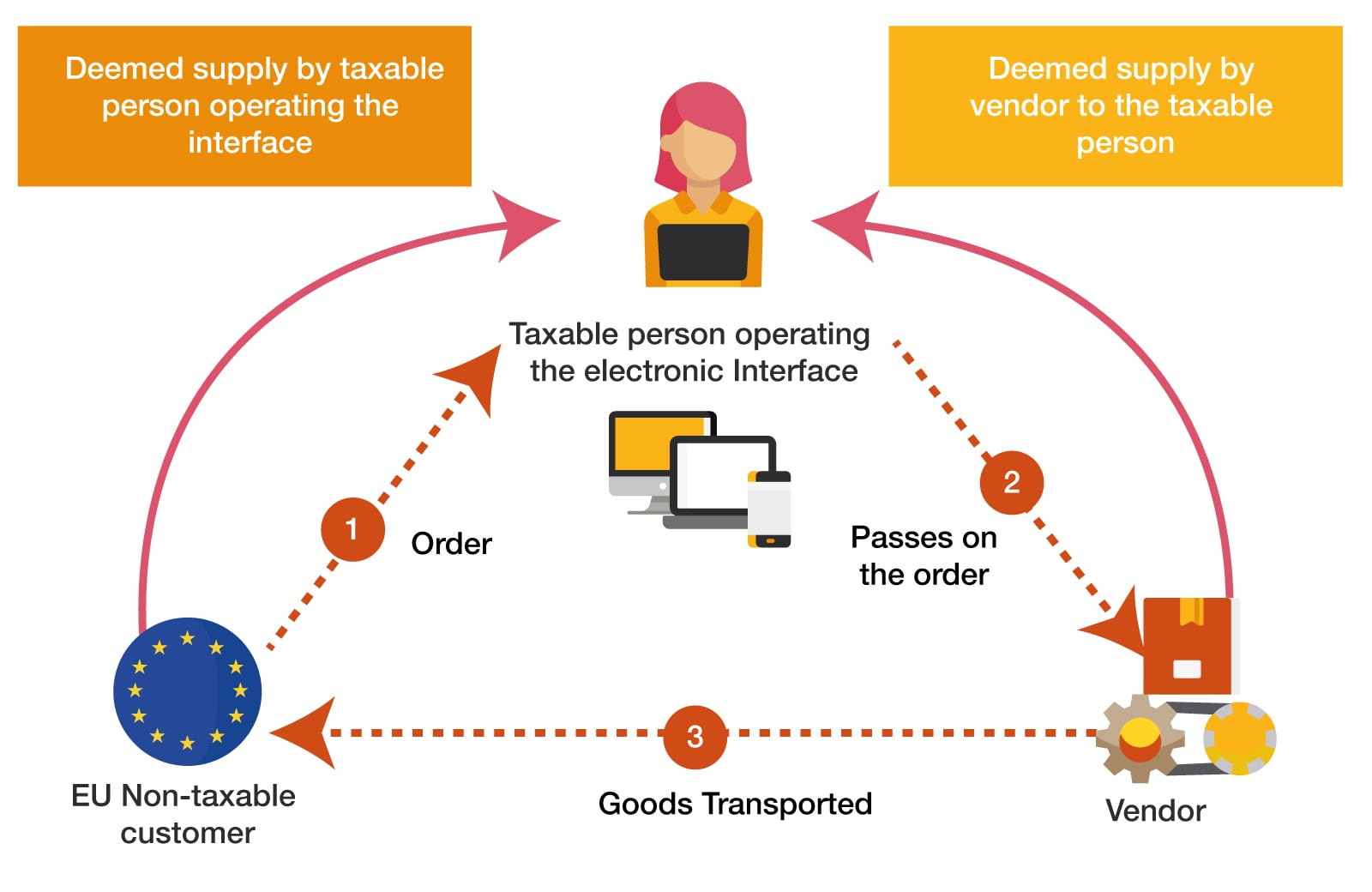

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

We Are Open: Superior Industrial Supply is Deemed Essential Infrastructure Support - Superior Industrial Supply | Blog | Hose, Accessories, Fasteners, Industrial Supplies in St. Louis Region